Type of Funding

The lenders we work with are purely asset based. They have to be non-owner occupied. You or your family can't be a resident of the property.

Types of Loans - Primary Lender

Premium JV Fix and Flip with Primary Lender:

*100% Purchase Price

*100% Rehab Cost

*100% Closing Costs

As long as all costs fall under 70% ARV. Costs above the 70% ARV, the investor will need to cover at closing. Your goal is to negotiate the least purchase price with the highest ARV to minimize the money the investor needs to bring to the closing table. Note, your credit score does not disqualify for this loan.

Standard Fix and Flip with Primary Lender

*90% Purchase Price

*90% Rehab Cost

Not to exceed 65% ARV

Rates 8%-15%

Both types can have Term of 6 - 24 months

Rental Purchase Loan

*80% LTV

*Min Credit score 650

Term 30 years

Cash Out Refi Loan

*65% LTV

*Min Credit score 650

Term Varies

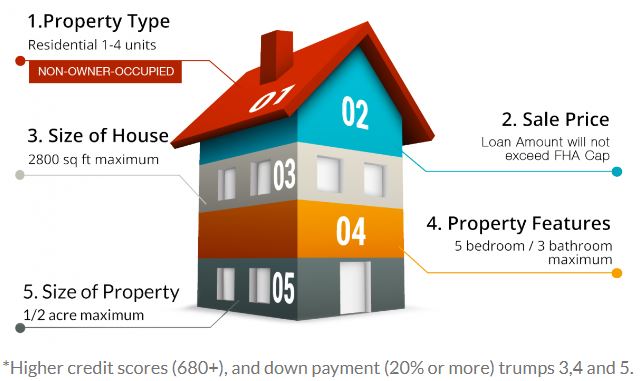

Primary Lender Asset Criteria

The Process

Apply for my broker service

I call you and collect the information the loan agent needs to create the loan estimate.

I submit your deal information to the loan agent at the lenders I work with.

The loan agent prepares the estimate and sends to me. I review it and if I am happy. I send it to you and schedule a time to go over it.

You decide which lender you are most happy with on their estimate. Then, I have you start the loan application process with the lender you chose which includes paying a loan app fee if they require it collected up front.

After the loan app fee is paid, you will need to gather the documents the underwriter needs. The loan officer prepares a more accurate loan estimate and sends to me. I send to you and we review.

If you are going for a fix and flip loan, after the loan app process is started, I will need you to get a repair estimated from a licensed contractor. This estimate is sent to the property appraiser to use in determining the appraised ARV for the loan.